An inverted yield curve means interest rates have flipped on u s.

What does inverted yield curve indicate.

An inverted yield curve occurs when short.

An inverted yield curve is most worrying when it occurs with treasury yields.

The term yield curve refers to the relationship between the short and long term interest rates of fixed income securities issued by the u s.

Treasury department sells them in 12 maturities.

What an inverted yield curve means.

In a normal yield curve.

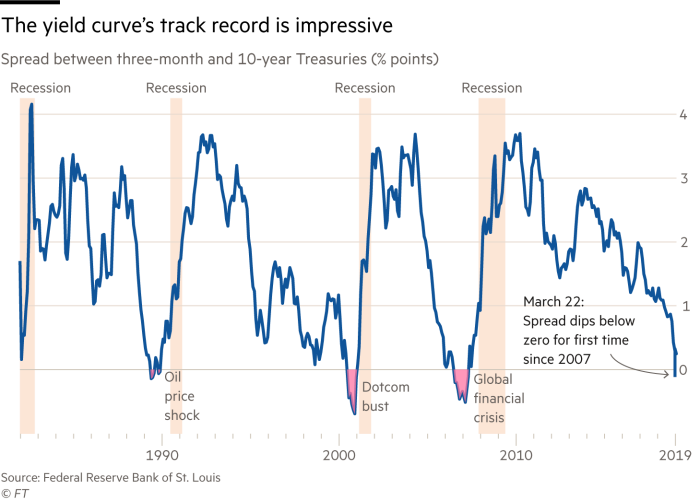

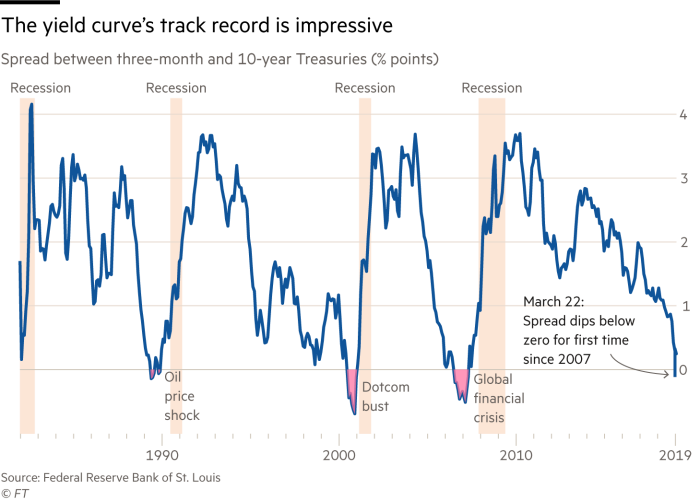

The current yield curve is hard to read people fear inverted yield curves because they tend to precede recessions.

It s generally regarded as a warning signs for the economy and.

While the yield curve has been inverted in a general sense for some time for a brief moment the yield of the 10 year treasury dipped below the yield of the 2 year treasury.

Treasurys with short term bonds paying more than long term bonds.

Reuters lucas jackson.

This hasn t happened.

An inverted yield curve is an indicator of trouble on the horizon when short term rates are higher than long term rates see october 2000 below.

An inverted yield curve is an interest rate environment in which long term debt instruments have a lower yield than short term debt instruments of the same credit quality.

They are.

Treasury yield curves federal reserve data.

It won t be immediate but recessions have followed inversions a few months to two years later several times over many decades.

That s when yields on short term treasury bills notes and bonds are higher than long term yields.

What does an inversion in the curve mean.

An inverted yield curve is generally considered a recession predictor.

The yield curve is considered inverted when long term bonds traditionally those with higher yields see their returns fall.

What is a yield curve and what does it mean when it s inverted.